SPOILER ALERT!

What Are Insurance Cases Adjuster - Should You Employ One?

Content author-Sheridan Valdez

A public insurance adjuster is an independent cases handler/claims analyst who represents for the insurance holder in discussing and also helping the insured/ insured event in helping to resolve its insurance claim. Public Insurers is independent insurance policy representatives. They are certified by the California Insurance Code Section 766. Public Insurance adjusters is not employed by the insurance company, yet are independent insurance coverage agents who are accountable for the fiduciary task of suggesting their customers about numerous issues related to their insurance coverage.

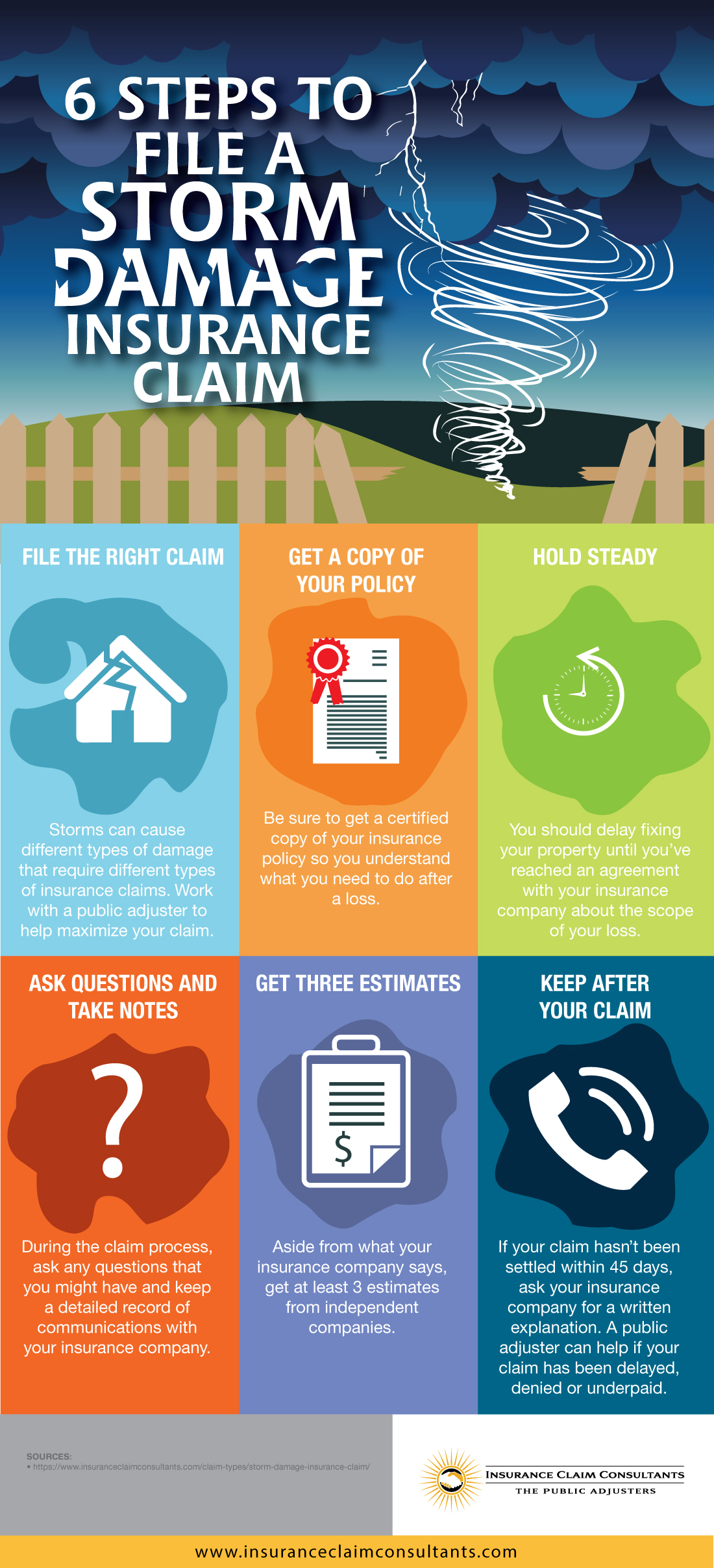

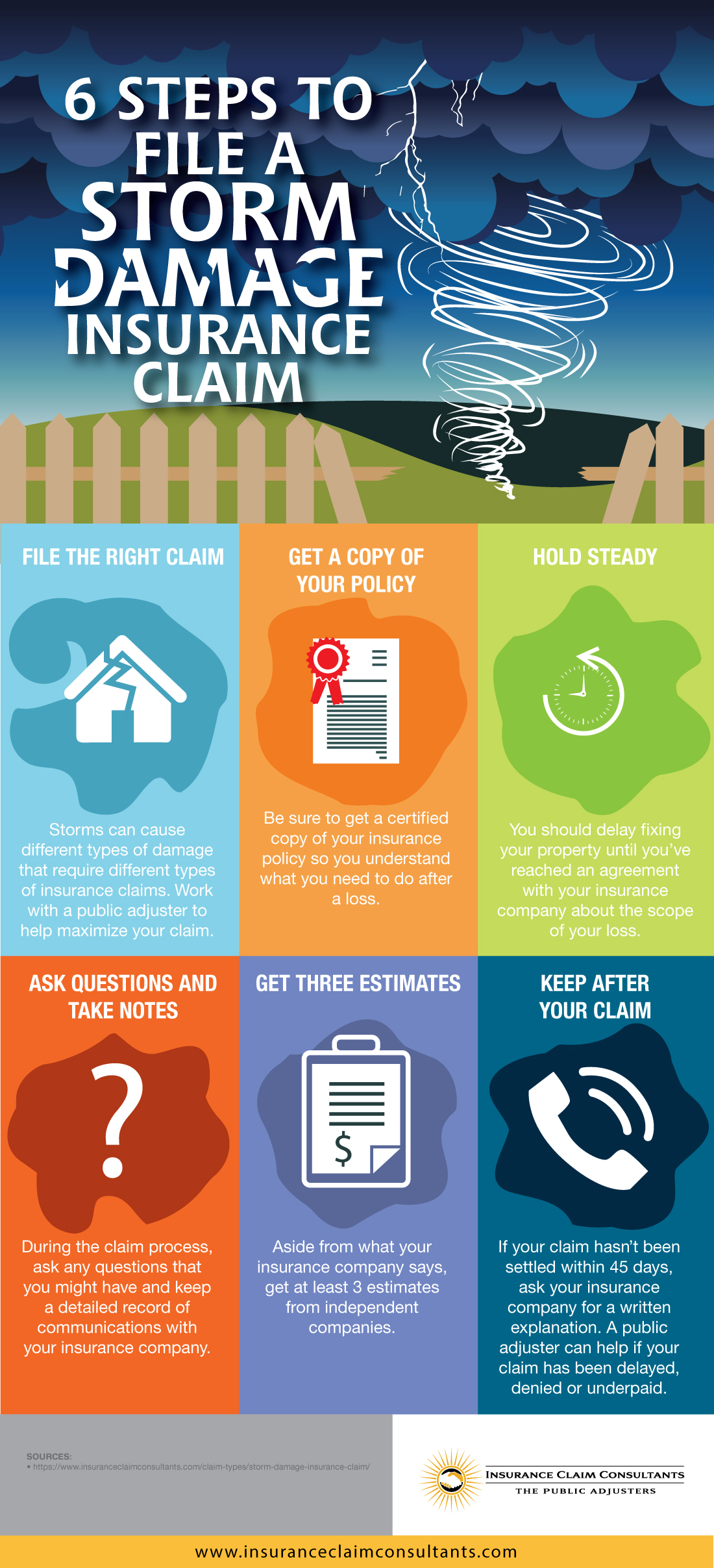

Public Insurance adjusters has three main tasks. Initially, they have to file all ideal cases kinds as well as reports. Second, they should prepare the records to effectively release or pay off the case if it is rejected by the insurance provider. Third, they must give the customer with a quote of all necessary repair work or reconstruction work.

Insurance companies make use of Public Insurers to make the decision of the negotiation quantity on smaller insurance claims. The Insurance coverage Department does not consider the general public Insurer's recommendation when making these determinations. If a Public Adjuster thinks the negotiation amount ought to be higher than what the insurance provider determines, he or she will certainly recommend the customer to file a claim for loss backup. If the customer does so, the Public Adjuster gets a percentage of the declared negotiation. If the insurance company concurs, after that the Public Adjuster concerns a decision in the event as well as forwards the suggestion to the customer.

Insurance coverage agents who represent the general public Insurance adjuster likewise play an important function in the whole settlement procedure. In most cases, these people have access to sensitive information. When the general public Adjuster establishes that a settlement amount ought to be greater than what the insurance provider determines, the insurance adjuster offers the info to the client. Insurance policy representatives might recommend their customer to take the offer from the insurance provider, if they do not intend to risk having to pay even more damages. Insurance coverage insurance adjusters are often the last resort for customers that do not have the moment or resources to pursue alternative opportunities.

How can you guarantee that you don't become the next target of Insurance coverage Insurance adjuster misuse? The simplest method is to simply ask the general public Insurance adjuster for paperwork concerning his or her referrals. A great Insurance policy agent will certainly be more than satisfied to supply such paperwork. In fact, it's far better to have documented proof revealing that your insurance claim was certainly justified, instead of having to turn to rash solutions that may hurt you in the future. Furthermore, you must ensure that you totally recognize the duty that the general public Insurer plays in your insurance policy industry.

Insurance Coverage Agents for Residential Or Commercial Property Insurance (PIP) are called for by legislation to be neutral. To do this, they must sign up with a nationwide organization. The National Organization of Insurance Commissioners (NACH) has actually outlined rules and also guidelines on how members must act. Amongst look at here are specifications that adjusters openly represent the interests of all insurance holders, also those that could have a various viewpoint. Although NACH makes sure that policyholders are treated relatively, it does not assure that they will constantly act in your best interest. Because of please click the following article , it's constantly smart to consult NACH before consenting to preserve a PIP representative or adjuster on your behalf.

What is much more troubling about the recent newspaper article is that several of individuals whose homes were ruined had not been properly notified. Numerous house owners simply downplay the loss, thinking that insurance coverage insurers will certainly iron out any troubles without any trouble whatsoever. In truth, insurance companies are not just worried about the payout, but additionally with making sure that their client's residential property is structurally sound. This is why it is essential that property owners do their very own research study and also contact regional public insurers as well as seasoned home inspectors to help them evaluate the damage. If property owners also wonder about the legitimacy of a PIP representative, it's best to stay away from the circumstance entirely, as fraudulence is just as genuine as neglect.

Plainly, house owners have a number of worries when it concerns insurance cases insurers. These are really real problems that deserve severe consideration, even when house owners really feel that they must have some input. As even more home owners realize the advantages of contacting regional PIP agents and also employing them for their services, the variety of complaints as well as missteps should start to ebb. Given these points, it is clear that house owners require to make themselves more aware of all the ways they can secure themselves from the dangerous whims of insurance coverage insurers.

A public insurance adjuster is an independent cases handler/claims analyst who represents for the insurance holder in discussing and also helping the insured/ insured event in helping to resolve its insurance claim. Public Insurers is independent insurance policy representatives. They are certified by the California Insurance Code Section 766. Public Insurance adjusters is not employed by the insurance company, yet are independent insurance coverage agents who are accountable for the fiduciary task of suggesting their customers about numerous issues related to their insurance coverage.

Public Insurance adjusters has three main tasks. Initially, they have to file all ideal cases kinds as well as reports. Second, they should prepare the records to effectively release or pay off the case if it is rejected by the insurance provider. Third, they must give the customer with a quote of all necessary repair work or reconstruction work.

Insurance companies make use of Public Insurers to make the decision of the negotiation quantity on smaller insurance claims. The Insurance coverage Department does not consider the general public Insurer's recommendation when making these determinations. If a Public Adjuster thinks the negotiation amount ought to be higher than what the insurance provider determines, he or she will certainly recommend the customer to file a claim for loss backup. If the customer does so, the Public Adjuster gets a percentage of the declared negotiation. If the insurance company concurs, after that the Public Adjuster concerns a decision in the event as well as forwards the suggestion to the customer.

Insurance coverage agents who represent the general public Insurance adjuster likewise play an important function in the whole settlement procedure. In most cases, these people have access to sensitive information. When the general public Adjuster establishes that a settlement amount ought to be greater than what the insurance provider determines, the insurance adjuster offers the info to the client. Insurance policy representatives might recommend their customer to take the offer from the insurance provider, if they do not intend to risk having to pay even more damages. Insurance coverage insurance adjusters are often the last resort for customers that do not have the moment or resources to pursue alternative opportunities.

How can you guarantee that you don't become the next target of Insurance coverage Insurance adjuster misuse? The simplest method is to simply ask the general public Insurance adjuster for paperwork concerning his or her referrals. A great Insurance policy agent will certainly be more than satisfied to supply such paperwork. In fact, it's far better to have documented proof revealing that your insurance claim was certainly justified, instead of having to turn to rash solutions that may hurt you in the future. Furthermore, you must ensure that you totally recognize the duty that the general public Insurer plays in your insurance policy industry.

Insurance Coverage Agents for Residential Or Commercial Property Insurance (PIP) are called for by legislation to be neutral. To do this, they must sign up with a nationwide organization. The National Organization of Insurance Commissioners (NACH) has actually outlined rules and also guidelines on how members must act. Amongst look at here are specifications that adjusters openly represent the interests of all insurance holders, also those that could have a various viewpoint. Although NACH makes sure that policyholders are treated relatively, it does not assure that they will constantly act in your best interest. Because of please click the following article , it's constantly smart to consult NACH before consenting to preserve a PIP representative or adjuster on your behalf.

What is much more troubling about the recent newspaper article is that several of individuals whose homes were ruined had not been properly notified. Numerous house owners simply downplay the loss, thinking that insurance coverage insurers will certainly iron out any troubles without any trouble whatsoever. In truth, insurance companies are not just worried about the payout, but additionally with making sure that their client's residential property is structurally sound. This is why it is essential that property owners do their very own research study and also contact regional public insurers as well as seasoned home inspectors to help them evaluate the damage. If property owners also wonder about the legitimacy of a PIP representative, it's best to stay away from the circumstance entirely, as fraudulence is just as genuine as neglect.

Plainly, house owners have a number of worries when it concerns insurance cases insurers. These are really real problems that deserve severe consideration, even when house owners really feel that they must have some input. As even more home owners realize the advantages of contacting regional PIP agents and also employing them for their services, the variety of complaints as well as missteps should start to ebb. Given these points, it is clear that house owners require to make themselves more aware of all the ways they can secure themselves from the dangerous whims of insurance coverage insurers.